What Are You Really Paying Your Current Manager?

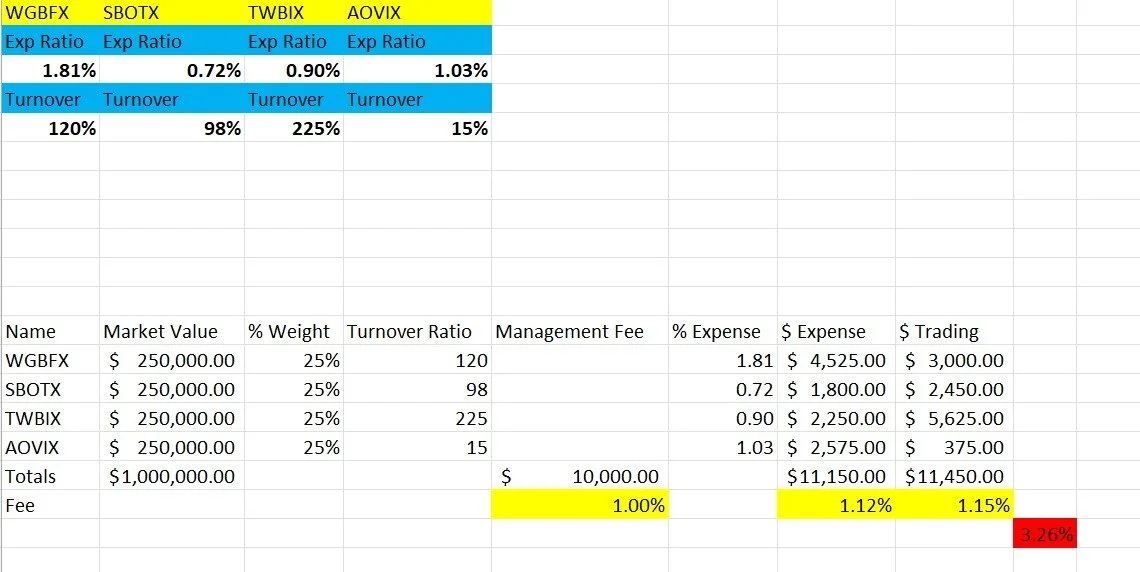

I selected four mutual fund managers and analyzed their expense ratios and turnover percentages. I also included a typical advisory management fee to show how total costs can add up.

This example illustrates how it’s possible to pay significantly more than a stated 1% management fee. Before even evaluating a manager’s performance, I believe it’s important to first screen out mutual funds with high expense ratios and high turnover (trading) costs. I generally prefer managers who rely on a long-term, buy-and-hold approach rather than excessive active trading.

In the Excel example, you may think you’re paying a 1% advisory fee, but once trading costs and mutual fund expense ratios are included, the total cost rises by an additional 2.26%.

The takeaway? Know what you own. There are often more costs involved than the stated management fee, especially when an advisor is using ETFs or mutual funds. Understanding these hidden costs can make a meaningful difference in your long-term returns.