Want To Participate In The Gold Trade But Want Some Insurance? We Got You.

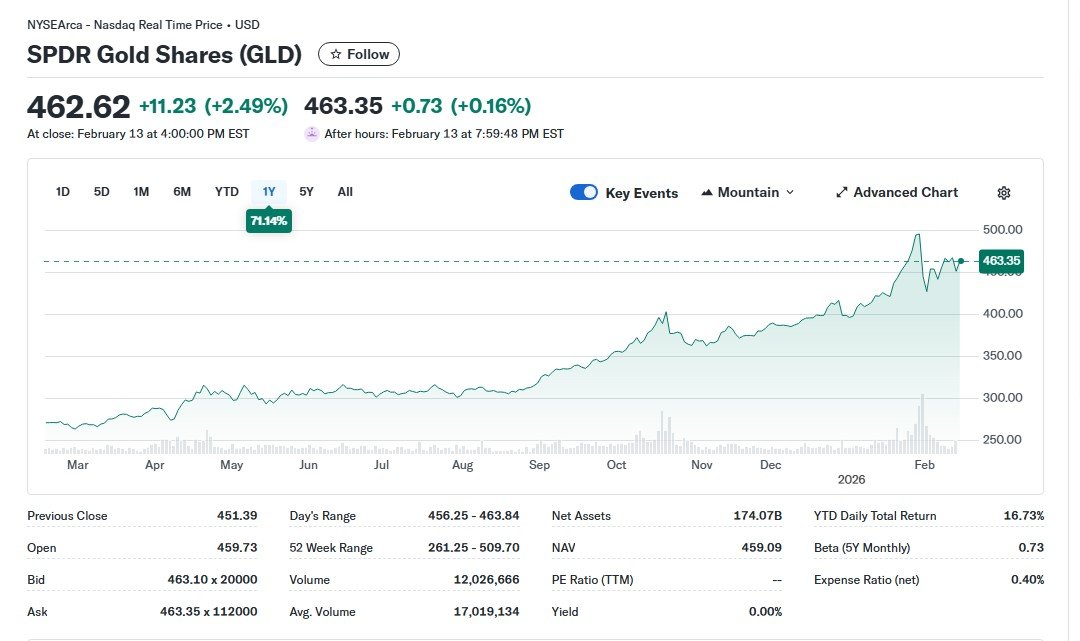

As of today, GLD is up 71.14% from one year ago. We, along with many other analysts, expect gold to continue moving higher, driven by structural and macroeconomic forces outlined in our recent analysis, which you can review here:

https://www.belvedereinvestmentsco.com/blog/expect-gold-to-climb-higher-in-2026

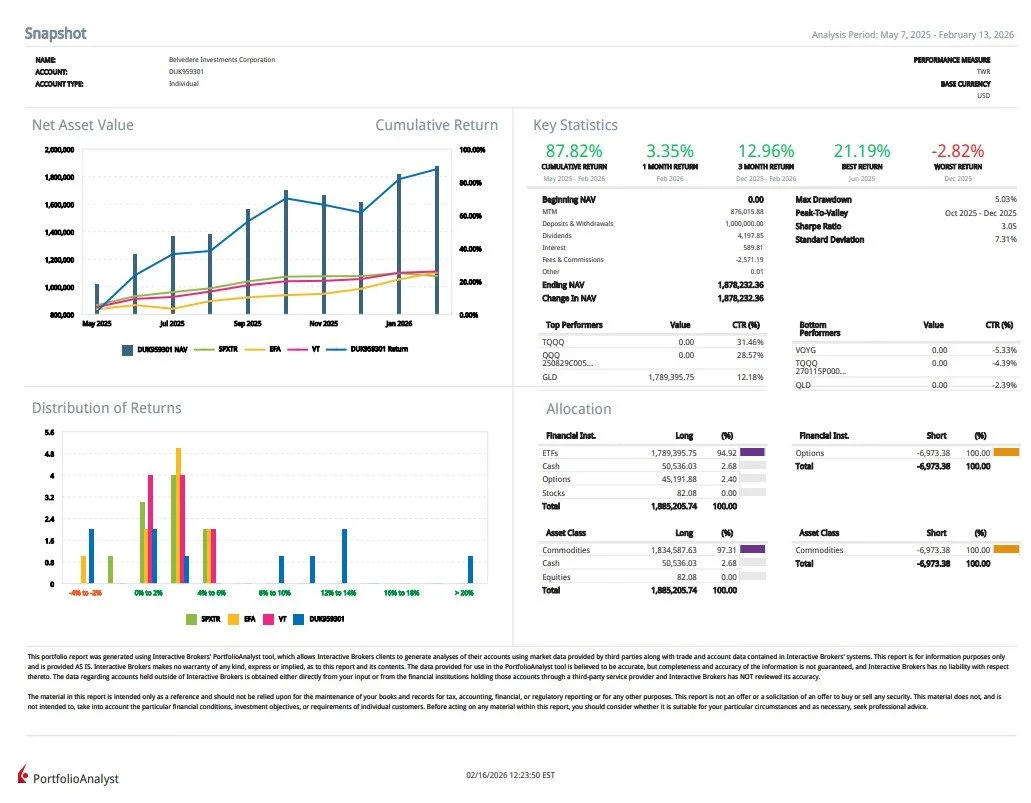

Using our hedging framework, we can provide a 10% downside buffer at a total annual drag of just 4.14%, or approximately $1,123,320 on a $25,000,000 portfolio. We can further reduce this cost by writing covered calls either monthly or further out on the curve, depending on your income and risk preferences.

In our view, gold has substantial upside from current levels. Sovereign debt burdens, persistent fiscal deficits, and ongoing debasement within the global fiat monetary system continue to erode purchasing power. Against this backdrop, gold serves not only as a hedge, but as a long-term store of value.

The macro environment strongly supports continued appreciation. The question is simple: why allow capital to lose value in real terms when it can be protected—and potentially compounded—through disciplined exposure to gold?

In one of our paper trading portfolios we took a multi strategy opportunistic/event driven approach. Last year with the liberation day sell offs we had an aggressive recovery up until October. We rode TQQQ and calls up. We then bought gold last year for this portfolio and are going to ride it up based on the current macro environment and tail winds for gold around the world. YTD we are up 16+ percent in this paper trading account.