Paper Trading Accounts

With paper trading accounts, I try to push the limits on risk and return. You cannot always look at a paper trading account and expect to achieve the same level of results you would with real money. That said, it is entirely possible to use put options and other risk management strategies to gain peace of mind.

The message I’d like to convey through this post is that we can serve any client, across any risk profile and any investment objective. Whether you are a pension fund seeking a conservative investment that remains competitive with its asset-class benchmark, or a high-risk speculator pursuing aggressive returns, we are equipped to serve a wide range of clients and investment goals.

Paper Trading Account 1: Since inception paper trading account 1. We rode TQQQ and call options up last year.

Benchmark: SPY —> 24.85%

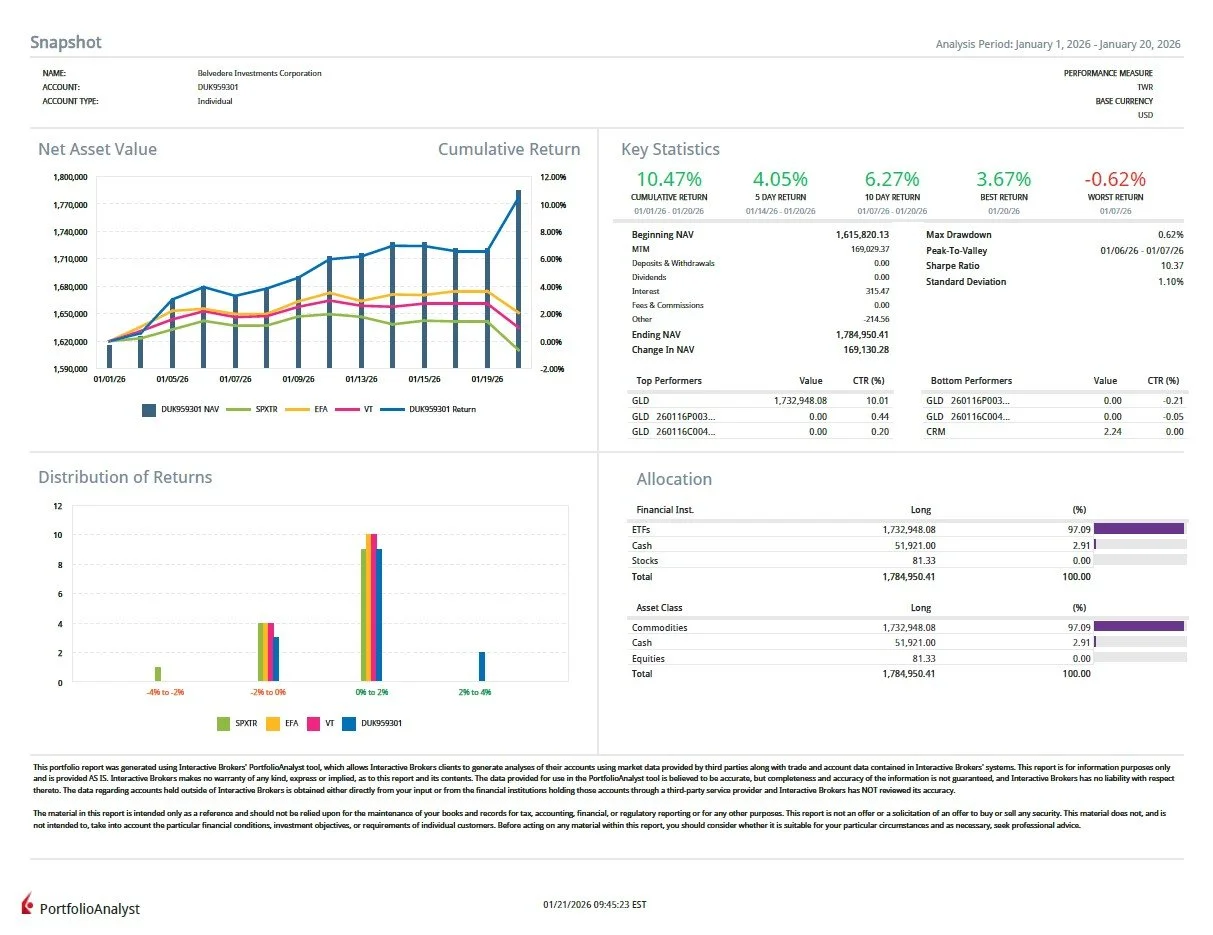

Paper Trading Account 1: In 2026 we have ridden GLD up so far.

Benchmark: SPY —> 1.43%

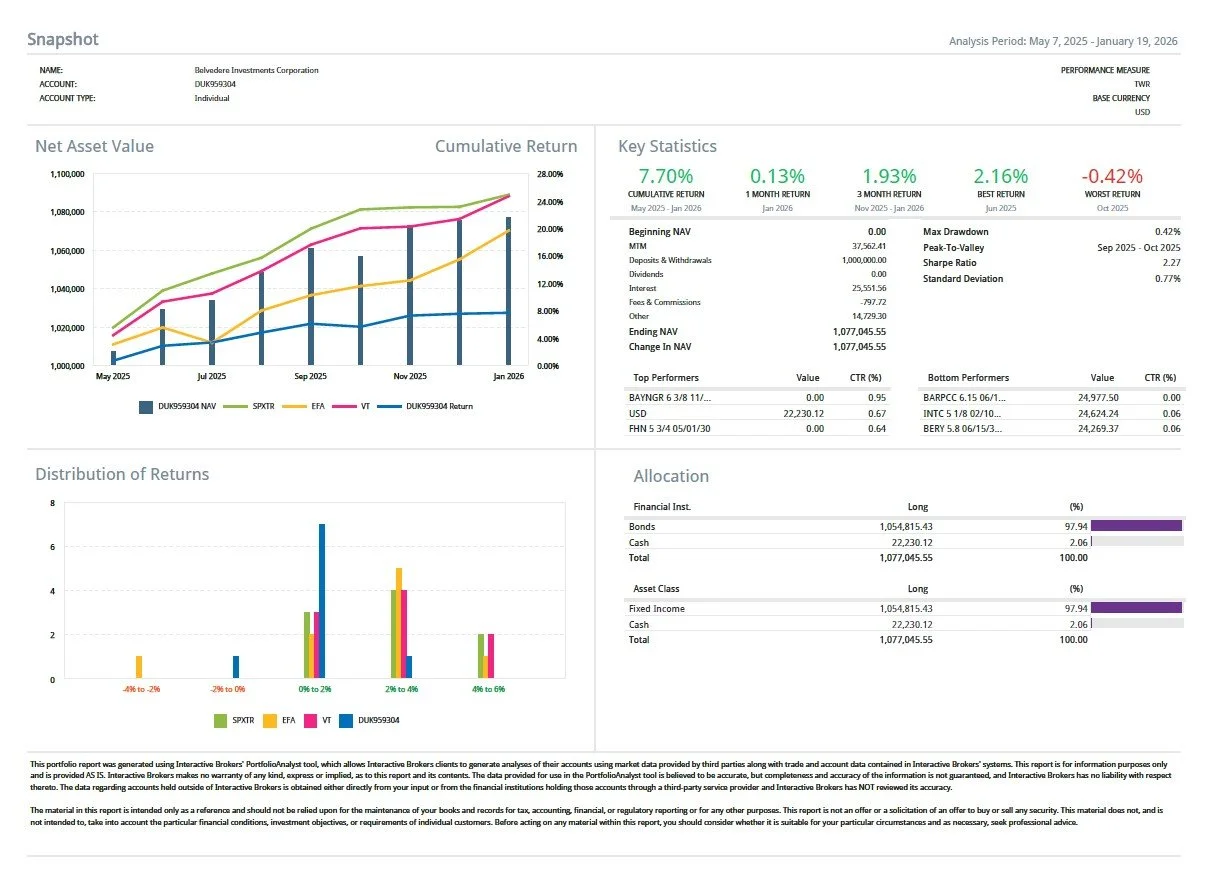

Paper Trading Account 2: Fixed Income Portfolio —> We used investment grade corporate bonds with leverage last year. Towards the end of the year we took leverage off. Currently we are still sitting in the same portfolio of bonds.

Benchmark: AGG —> 4.79%