Options Hedging Drag + Drag Reduction

Example:

We buy QQQ puts and the drag comes out to 4.09% or 4.75% when annualized. These put contracts expire 12/31/2026. (if we were to buy puts further out the annualized drag would be less, but if we can we try to do everything on a year to year basis (12-13 months). We would write 720 calls expiring the same time (12/31/2026). based on our current bids we would generate $200,772 or 49.14% of the put cost which was $408,564. When we do this we just cut our cost in half and have given us a run way of 18-19 percent, in a year where earnings growth is expected to be less than that, where many analysts have pegged $715 at the top of the range and where the likelihood of QQQ blowing past $720 strike is very low…we have a 80%+ probability of this trade going in our favor and not missing out on any upside gains.

The strategy can work without the covered call, but the covered call helps us pay for the cost of the insurance…the market does not have to go as far or work as hard…now we would not write this far out every year for the calls, it depends on market conditions, probability of success, and whether we are in choppy markets (which we are given it is an election year historically). So no, the covered call writing is not necessary but it definitely helps.

If we had to sell a put early because we had massive gains and want to lock in those gains like in 2023 we could do that. The selling of the old put and the buying of the new put would add some drag to the portfolio because the old put had not run till full expiration but its a negligible amount, especially in years with large gains like 2023.

When to hedge, how to hedge, when to write covered calls, how often to write covered calls, that is the skill within the strategy. We rely on the efficiency of the index fund to generate our gains and maintain less volatility when compared to a low count single stock portfolios. The strategy really combines a lot of great things into a well defined simple strategy that is effective over time at providing good returns, better risk management, and stability.

Hedge drag based on various downside protections below (puts with 12/31/2026 expiration)

We have 314 days until expiration (12/31/2026), not a full year…we believe the market is going to have limited growth this year and be relatively flat or neutral compared to past years…thus we feel comfortable writing covered calls not on monthly basis but till the end of 2026. VIX is currently below 20.

20% Cap: 2.16% drag - covered call income 2.03% = 0.13% + 0.60% mgmt. fee = 0.73% total drag

10% Cap: 4.13% drag - covered call income 1.99% = 2.14% + 0.60% mgmt. fee = 2.74% total drag

5% Cap: 5.30% drag - covered call income 1.97% = 3.33% + 0.60% mgmt. fee = 3.93% total drag

0% Cap: 6.66% drag - covered call income 1.93% = 4.73% + 0.60% mgmt. fee = 5.33% total drag.

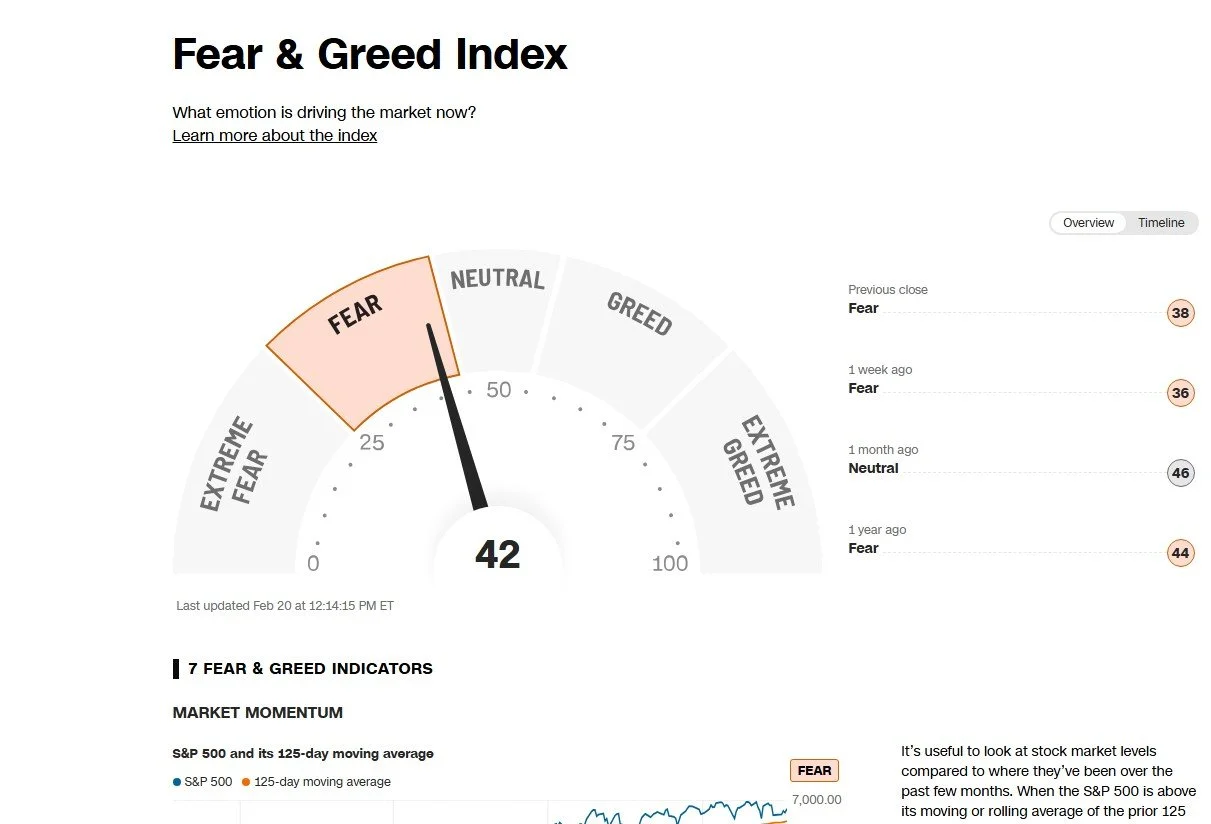

(just FYI, the fear in the market is apparent, in years past the cost of protection has not been so much….I think the market is very concerned right now about valuations, the geopolitical landscape, and the AI bet playing out…aka will AI deliver on growth, on earnings, and everything we’ve been made to believe it can be?