Food For Thought: Good Managers vs Bad Managers

What Separates Good Asset Managers from Bad Ones?

Good asset managers think probabilistically, not predictively. In the words of Howard Marks, “You can’t predict, but you can prepare.” We build our portfolios with preparation top of mind. We want quality companies, we want a shot at beating the S&P 500, we want risk management in place to protect us when market turmoil occurs, we aim to drive strong alpha for the portfolio, and we want to use tried and tested strategies — we are not trying to reinvent the wheel.

Given our wants and needs, we can build out a portfolio that is able to do all or most of the things we want while keeping risk in check. I talk about the things we do for our portfolios in the investment thesis part of the website, so I will not go into that here. To me, the real skill of a manager is not just return, although return definitely matters. To me, skill is whether you can meet or exceed the indexes/benchmarks and be down 10% when the market is down 20%. That takes skill, a strategy, and ongoing monitoring and management.

I align with Warren Buffett and Charlie Munger’s philosophy on diversification: “Over-diversification is the enemy of high returns.” Throughout my career, I’ve seen a wide range of portfolio management styles. In my view, many firms are either over-diversified or simply pursuing the wrong strategies if the goal is to meet or outperform benchmarks. You can have both, superior returns and effective risk management. The idea that you must own every sector or every market cap is, in my opinion, misguided. Concentration in high-quality businesses with strong growth potential is often the better approach.

Open-mindedness — that, to me, is what makes a great investor. In the valuation tab, Howard Marks talks about value investing with a capital “V” and value investing with a small “v.” He talks about how some in that sect are too narrow-minded. Now, I am not picking on value investors; I am just mentioning them because he referenced them in the video. Regardless of your strategy and skill set, the ability to think openly about something and consider alternatives can make a difference when it comes to investing. I try to have an open mindset about things. I don’t assume I know everything and understand that there are much smarter and better-equipped people out there than myself. I am agnostic to investment approach or strategy — growth investing, value investing, whatever it is — the only thing I care about is, “Does this strategy work, and can I put something together that meets the wants and needs I mentioned above?” That is my mindset when it comes to investing: be agnostic to strategy because strategies and investment approaches will change over time but be super focused when it comes to delivering the wants and needs of the client. In the words of Jeff Bezos, you could say we are “client obsessed.” It does not matter how things get done, only that they get done and deliver the intended results for the client.

A quote I love is from the movie Apollo 13. The NASA flight director says, “I don’t care what anything was designed to do; I care about what it can do.” I have the same mindset when it comes to problem-solving. What works for me might not work for you, and what works for you might not work for me. We have to think pragmatically and use the tools we have at our disposal to the best of our abilities. We have a brain — use it. Think creatively. Think freely. Don’t be tied down by dogma of other people’s approach or thinking. That is how we try to think and approach investing at Belvedere.

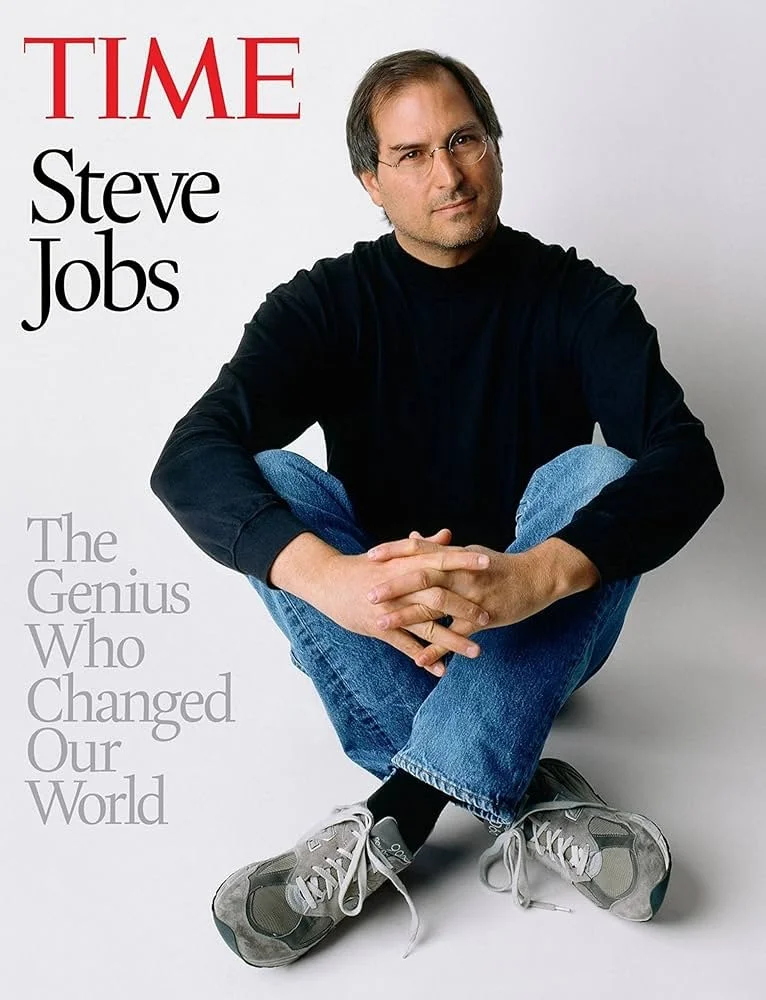

I really appreciate the “think different” mindset of Steve Jobs. Jobs thought freely and creatively in the field of technology. He metaphorically reached out and pushed buttons that changed and influenced the world in which he lived.