1970s And Now

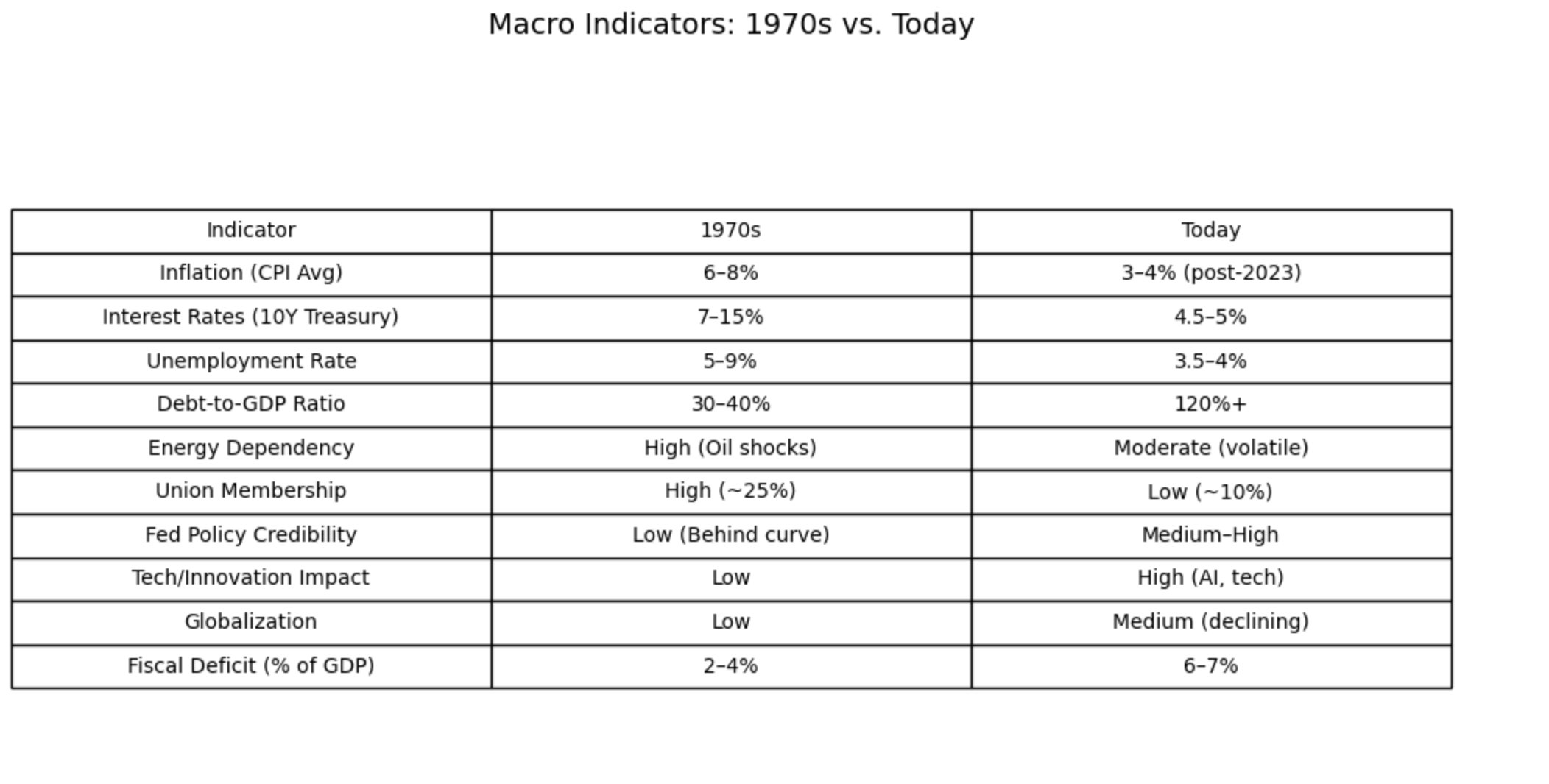

We have been hearing about potential economic stagflation so I did some research on macro economic data compared to the 70s and current day and above is what I found. See further below for a recommendation on how we might want to invest our money if we deal with a 70s style stagflation event again.

Throughout the last 125 years there have been three times where the markets traded sideways for multiple years (10+). The great depression, 1970s stagflation, and the 2000s dotcom bubble and great recession. How should we invest our money if we enter into another time where markets trade side ways?

1) Be diversified. Don’t have all your money in stocks, keep some of your money in inflationary resistant resistant assets like gold or real estate.

2) Pick a manager that trades on volatility and not entirely based on fundamental or traditional investment management. When I think volatility I think of my interns options trading strategy. He is a quant and has an algorithmic trading model that would function well in times of great volatility.

3) You diversify asset classes with stocks and real estate but you should also diversify in terms of the investment strategies itself. I foresee a situation where quantitative trading firms really perform well during times of economic stagflation.

4) Monitor global and emerging markets for opportunities. If the dollars buying power continues to decline there might be opportunities abroad in emerging economies.

5) Keep enough cash on hand for the right buying opportunities.

From the list above the best things I see and what could truly bring a client value during a time of economic stagflation is being diversified across asset classes and investment strategies (options trading strategies that focus on volatility).

If we see a combination of rising inflation, slowing GDP, and increasing unemployment over several quarters, stagflation is likely. For example, if by late 2025, CPI hits 6%, GDP growth is near 0%, and unemployment rises to 5.5%, those would be strong indicators that we are in a stagflation market.

Forbes Article: Jamie Dimon on Stagflation

https://www.forbes.com/sites/siladityaray/2025/05/22/theres-a-chance-stagflation-may-happen-jpmorgan-ceo-jamie-dimon-warns/

This is a heat map of how different asset classes performed/could have performed based on the past and how asset classes are performing/could perform in the future based on the current economic environment. Obviously crypto was not around the 70s, this is just a projection of how it could have performed, maybe I should take that out but my guess is, it would have performed better than other assets.